Stock Market

Franklin Technology Fund: A Smart Bet on Future Tech

The Franklin Technology Fund is one of the flagship offerings from Franklin Templeton Investments. Known for its strong focus on innovation, the fund targets high-growth technology companies worldwide. It is also widely referred to as the Franklin Templeton Technology Fund and is considered a go-to option for those looking to diversify their portfolios into the ever-evolving tech sector.

Why Invest in Franklin Technology Mutual Fund?

The technology sector has historically outperformed other sectors due to rapid innovation, scalability, and global demand. The Franklin Technology Mutual Fund taps into these dynamics by investing in companies that are leaders in areas like AI, cloud computing, semiconductors, and digital infrastructure. If you’re seeking exposure to top-performing tech stocks, this fund could be a compelling option.

Franklin Technology Fund Performance

One of the primary attractions is the Franklin Technology Fund performance over the years. While tech funds are known for their volatility, Franklin has shown resilience and consistent growth. In 2024, the Franklin tech fund returns exceeded market benchmarks, making it a solid performer among technology sector mutual funds.

Franklin Technology Fund Holdings

Curious about what powers this fund? The Franklin Technology Fund holdings include big names like Apple, Nvidia, Microsoft, and emerging tech players such as ASML and Snowflake. This mix of large-cap tech giants and innovative disruptors gives the fund a unique edge.

A Deep Franklin Technology Fund Review

Based on investor sentiment and performance metrics, our Franklin Technology Fund review reveals a well-diversified, growth-oriented portfolio. The fund consistently aligns with long-term tech trends and is managed by experienced professionals who understand the nuances of global innovation.

Franklin Technology Fund Analysis

A deeper Franklin Technology Fund analysis shows that the portfolio is structured to balance risk and reward. It leans toward companies with strong fundamentals and potential for exponential growth. The fund also frequently rotates sectors within tech, capitalizing on emerging sub-sectors like AI and quantum computing.

Franklin Technology Fund Portfolio Breakdown

The Franklin Technology Fund portfolio is about 70% U.S.-based tech companies, with the remaining 30% invested internationally. This global diversification makes it one of the leading global tech mutual funds today.

Understanding Franklin Technology Fund NAV

The Franklin Technology Fund NAV (Net Asset Value) is updated daily and reflects the fund’s per-share market value. It helps investors track their investment performance and make informed decisions.

Franklin Technology Fund Growth Prospects

Tech growth is not slowing down. The Franklin Technology Fund growth trajectory aligns with major tech innovations. Its strategy focuses on high-growth, scalable tech solutions with global market demand.

Franklin Technology Fund Assets and AUM

The fund manages billions in assets. The Franklin tech fund AUM (Assets Under Management) has grown steadily, indicating strong investor trust and confidence in its long-term performance.

Franklin Technology Fund Fees and Expense Ratio

The Franklin Technology Fund fees are competitive compared to other tech-focused mutual funds. With a reasonable expense ratio, investors benefit from active management without incurring high costs.

Franklin Technology Fund Returns and Benchmark

The Franklin Technology Fund benchmark is typically the NASDAQ-100 or S&P Technology index. The Franklin tech fund past performance consistently mirrors or beats these benchmarks, proving its robust investment strategy.

Franklin Templeton Innovation Fund vs. Others

The Franklin Templeton Innovation Fund is a variant that focuses even more on futuristic tech. When comparing Franklin tech fund vs Fidelity, the former leans more on high-risk/high-reward innovation, while Fidelity often plays it safer with large-cap tech.

Franklin Technology Fund for Beginners

It’s one of the better tech mutual funds for beginners due to its diversified holdings and professional management. A Franklin tech fund SIP (Systematic Investment Plan) allows small but regular investments, making it accessible to new investors.

Who Manages Franklin Technology Investment Fund?

The Franklin technology fund manager team is composed of experienced tech analysts and fund managers who bring in decades of experience. They closely monitor global tech trends and adjust the portfolio accordingly.

Technology Sector Performance in 2025

So far, the technology sector mutual fund landscape in 2025 has seen steady gains. The Franklin technology fund 2025 outlook remains bullish due to trends in AI, green tech, and digital infrastructure.

Franklin Templeton Equity Funds and Tech Focus

Among all Franklin Templeton equity funds, the technology fund stands out due to its concentrated focus and above-average returns. It’s an ideal option for tech-savvy investors or anyone looking to capitalize on digital transformation.

Franklin Technology Fund USA Focus

While globally diversified, a large portion of the Franklin Technology Fund USA investments reflect its bullish stance on American innovation hubs like Silicon Valley and Seattle.

Technology Mutual Fund Investment Strategy

As a technology mutual fund investment, it applies a blend of top-down and bottom-up approaches. This helps in capturing macroeconomic trends while also spotting company-specific opportunities.

Franklin Templeton Tech Portfolio Outlook

The Franklin Templeton tech portfolio is well-poised for long-term success. Key drivers include continued adoption of 5G, IoT, and AI.

Final Thoughts: Should You Invest in Franklin Technology Fund?

To invest in Franklin Technology Fund is to believe in the long-term future of technology. Its solid track record, skilled management, and diversified holdings make it one of the top tech mutual funds to invest in for 2025 and beyond.

FAQs About Franklin Technology Fund

- What is the Franklin Technology Fund? It’s a tech-focused mutual fund by Franklin Templeton that invests in high-growth technology companies.

- Is the Franklin Technology Fund a good investment in 2025? Yes, it offers strong exposure to emerging tech trends with a positive outlook.

- What companies are in the Franklin Technology Fund holdings? Holdings include Apple, Microsoft, Nvidia, ASML, and Snowflake.

- How has the Franklin Technology Fund performed historically? It has consistently outperformed sector benchmarks.

- What is the Franklin Technology Fund NAV? NAV represents the per-unit price of the fund, updated daily.

- Is this fund suitable for beginners? Yes, especially when investing through a SIP.

- What is the minimum investment amount? It varies depending on the platform and investment method.

- Can I invest in the Franklin Technology Fund from outside the USA? Yes, it is accessible globally through various investment platforms.

- What is the fund’s expense ratio? It has a competitive expense ratio among tech mutual funds.

- How often are holdings updated? Generally quarterly, though top holdings may be disclosed more frequently.

- What sectors within tech does it focus on? AI, cloud computing, semiconductors, and green tech.

- How does it compare to Fidelity’s tech fund? Franklin leans more into high-growth, while Fidelity often prefers established firms.

- Is it actively managed? Yes, with a dedicated team of tech analysts and managers.

- Can I redeem units anytime? Yes, but check for exit loads or fees on early redemption.

- Is it available on all platforms? Most major mutual fund platforms offer it.

- Is there a SIP option? Yes, making it accessible to new investors.

- Does it pay dividends? It may, depending on earnings and the distribution policy.

- What is the fund’s benchmark? Usually the NASDAQ-100 or a tech-heavy S&P index.

- Can I track it online? Yes, NAV and performance data are available on Franklin Templeton’s website.

- Is the Franklin Technology Fund safe? While no investment is without risk, this fund is diversified and professionally managed, making it a relatively safer bet within the tech sector.

Stock Market

FSSA Dividend Advantage: A Long-Term Investor’s Gem

The FSSA Dividend Advantage is a renowned equity income fund designed to tap into the power of dividend-paying companies, particularly across the Asia Pacific and emerging markets. It is crafted with a long-term view, aiming to deliver both sustainable income and capital appreciation. Managed by experienced professionals, the fund has carved a niche for investors seeking growth and yield in one basket.

FSSA Dividend Advantage Performance

When it comes to long-term investing, performance speaks volumes. The FSSA Dividend Advantage performance has shown resilience, with consistent returns even through volatile markets. Its emphasis on quality, cash-generating companies helps cushion downturns while capturing upside potential. Historical FSSA Dividend Advantage long-term returns indicate healthy capital appreciation alongside a competitive dividend yield.

The Fund Strategy: Quality and Sustainability

FSSA Dividend Advantage investment strategy revolves around investing in companies with robust balance sheets, sustainable dividend payouts, and strong corporate governance. With a bottom-up approach, the fund focuses on quality companies rather than chasing high yields. This strategy minimizes the FSSA Dividend Advantage risk by reducing exposure to highly leveraged or cyclical businesses.

FSSA Dividend Advantage Portfolio Breakdown

The FSSA Dividend Advantage portfolio reflects a strong tilt towards consumer, financial, and healthcare sectors. These sectors are chosen for their defensive characteristics and ability to provide steady cash flows. In terms of regions, the fund emphasizes Asia Pacific and emerging markets—areas with strong demographic and economic growth.

Holdings and Top Contributors

Some of the key FSSA Dividend Advantage top holdings include multinationals and regional champions with solid dividend histories. These businesses form the backbone of the fund’s consistent income generation. The FSSA Dividend Advantage holdings tend to be less volatile, providing a cushion in turbulent markets.

FSSA Dividend Advantage Fund Manager Insight

The fund is steered by experienced professionals known for deep market understanding. The FSSA Dividend Advantage fund manager provides a disciplined and research-driven approach to stock selection, ensuring each holding contributes to the fund’s objectives.

Dividend Yield and Income Generation

Investors often ask about the FSSA Dividend Advantage yield. The fund aims for a sustainable dividend payout, which generally falls between 3% and 5%, depending on market conditions. FSSA Dividend Advantage income stability makes it suitable for retirees or those seeking passive income.

ESG Focus and Sustainability

FSSA Dividend Advantage sustainability is integrated into the investment process. Companies are selected based on environmental, social, and governance (ESG) criteria. The fund’s positive FSSA Dividend Advantage ESG rating shows its commitment to responsible investing.

FSSA Dividend Advantage Class B and Fund Structure

FSSA Dividend Advantage Class B shares are commonly chosen for their reinvestment options and cost efficiency. The fund’s structure supports accumulation and distribution, catering to different investor needs.

Comparison and Benchmarking

FSSA Dividend Advantage comparison with other income funds often highlights its lower volatility and better downside protection. The fund’s unique approach allows it to shine in both bull and bear markets.

FSSA Dividend Advantage Review: What Analysts Say

Analyst-driven FSSA Dividend Advantage reviews often praise the fund for its disciplined process and consistent returns. Its risk-adjusted performance is one of the best in its category, making it a favorite among dividend investors.

Factsheets and Fund Documents

For in-depth information, the FSSA Dividend Advantage factsheet or FSSA Dividend Advantage fund factsheet PDF provide updated data on performance, portfolio allocation, and commentary. These documents include FSSA Dividend Advantage net asset value (NAV), FSSA Dividend Advantage distribution dates, and yield figures.

Annual Reports and Prospectus

The FSSA Dividend Advantage annual report and prospectus offer detailed insights into fund operations, financials, and strategy updates. These reports also outline the FSSA Dividend Advantage fund objective and upcoming market outlook.

Growth Potential and Outlook

The FSSA Dividend Advantage growth trajectory is driven by structural trends in Asia Pacific and emerging markets. The FSSA Dividend Advantage outlook remains optimistic, especially as developing economies continue to expand and urbanize.

Price Movements and Share Value

FSSA Dividend Advantage share price trends show consistent growth over time. Investors tracking the FSSA Dividend Advantage price can see it reflects the underlying performance and dividend payouts.

Risk and Volatility Profile

The FSSA Dividend Advantage volatility is relatively low compared to peers. Its diversified and conservative stock-picking approach results in smoother returns, especially during market shocks.

FSSA Dividend Advantage Trust Structure

As an investment trust, the FSSA Dividend Advantage trust structure provides liquidity and transparency, aligning with the interests of retail and institutional investors.

Distribution and Dividend History

Regular FSSA Dividend Advantage dividends make the fund attractive for income seekers. The fund follows a stable distribution policy, aligning with its yield and performance targets.

Who Should Invest in This Fund?

Whether you’re a retiree looking for income, or a young professional building wealth, the FSSA Dividend Advantage investment offers a balanced exposure to income and growth. It’s ideal for those with a long-term horizon and moderate risk appetite.

FAQs About FSSA Dividend Advantage

1. What is the FSSA Dividend Advantage fund? It’s an equity income fund investing primarily in Asia Pacific and emerging market dividend-paying companies.

2. Who manages the FSSA Dividend Advantage? The fund is managed by a team of seasoned professionals under First Sentier Investors.

3. What is the FSSA Dividend Advantage yield? The fund offers a dividend yield of approximately 3–5%, subject to market conditions.

4. Where does the FSSA Dividend Advantage invest? Primarily in Asia Pacific and emerging markets with a focus on quality companies.

5. What are the top sectors in the FSSA Dividend Advantage portfolio? Consumer, financials, and healthcare sectors dominate the portfolio.

6. Is the FSSA Dividend Advantage fund good for long-term investors? Yes, it’s designed for income and growth over the long term.

7. What is the NAV of the FSSA Dividend Advantage fund? The NAV is published regularly in the fund’s factsheet and on financial platforms.

8. How often are dividends distributed? Typically quarterly or semi-annually, depending on the share class.

9. What is the risk level of the FSSA Dividend Advantage? Moderate. It avoids high-risk, cyclical stocks and emphasizes stable dividend payers.

10. Is there a prospectus available? Yes, the FSSA Dividend Advantage prospectus is available through First Sentier Investors.

11. How does it compare to similar funds? It stands out for its risk-adjusted performance, ESG focus, and long-term track record.

12. Is the FSSA Dividend Advantage available in the UK? Yes, including via platforms like HL, Fidelity, and AJ Bell.

13. Can I reinvest dividends? Yes, depending on the share class (like Class B), you can reinvest dividends.

14. What is in the latest FSSA Dividend Advantage factsheet? Details on performance, top holdings, NAV, and manager commentary.

15. What are the long-term returns like? The fund has shown solid long-term returns with lower-than-average volatility.

16. What is the investment minimum? This varies by platform and jurisdiction, generally starting from £500 or equivalent.

17. Are there any sustainability factors? Yes, the fund integrates ESG criteria into its investment process.

18. How is the FSSA Dividend Advantage price determined? It’s based on the NAV and market conditions.

19. What are the fund’s fees? Management and performance fees vary by share class; check the prospectus for exact figures.

20. What is the FSSA Dividend Advantage investor report? A regular publication detailing fund updates, performance insights, and strategy outlook.

Final Thoughts

The FSSA Dividend Advantage stands out as a robust, income-focused investment option for those seeking a blend of stability and growth. Its disciplined strategy, quality stock selection, and ESG integration make it a compelling choice in today’s market landscape. Whether you’re evaluating the FSSA Dividend Advantage fund performance, portfolio makeup, or dividend yield, this fund offers a holistic and sustainable investment path.

Stock Market

Geo Energy Sharejunction Analysis for 2025

Geo Energy Sharejunction has been popping up in almost every investor chat I’ve joined lately—and not without good reason. Imagine scrolling through your feed, skipping over the usual market noise, and there it is: Geo Energy, making waves on the SGX like it’s headlining a K-pop concert. Investors, both seasoned and newbies (like my cousin who just discovered dividends are not a kind of pizza), are eyeing this Singapore-based coal player for its steady payouts and ambitious future outlook. The company’s not just talking the talk—it’s knee-deep in coal dust in Indonesia, where it’s mining, moving, and exporting like a well-oiled machine.

I first heard about Geo Energy Singapore from a friend over coffee who whispered about “coal being the new black,” and while I rolled my eyes, I looked it up—and boom, there was real potential. This company isn’t just sitting on coal—it’s leveraging it. The dividends? Reliable. The Geo Energy share price? Buzzing. The future outlook? Bright enough to need shades, even in a mining pit.

Geo Energy Company Profile

Geo Energy is a Singapore-based public company focused on coal mining and energy-related services. It operates primarily in Indonesia, where it manages several coal mining concessions. The company’s core strength lies in its integrated business model, which spans coal mining, logistics, and export operations. According to the latest Geo Energy quarterly report, the firm has made significant improvements in production efficiency and revenue.

Geo Energy Financials and Earnings Overview

Recent Geo Energy financials indicate stable performance, supported by healthy earnings from strong coal demand. In its latest Geo Energy earnings release, the company reported a notable increase in net profit compared to the previous year. This growth is attributed to higher coal exports, cost control measures, and favorable commodity prices. The Geo Energy market cap has also seen an uptick, reflecting investor confidence in its operations.

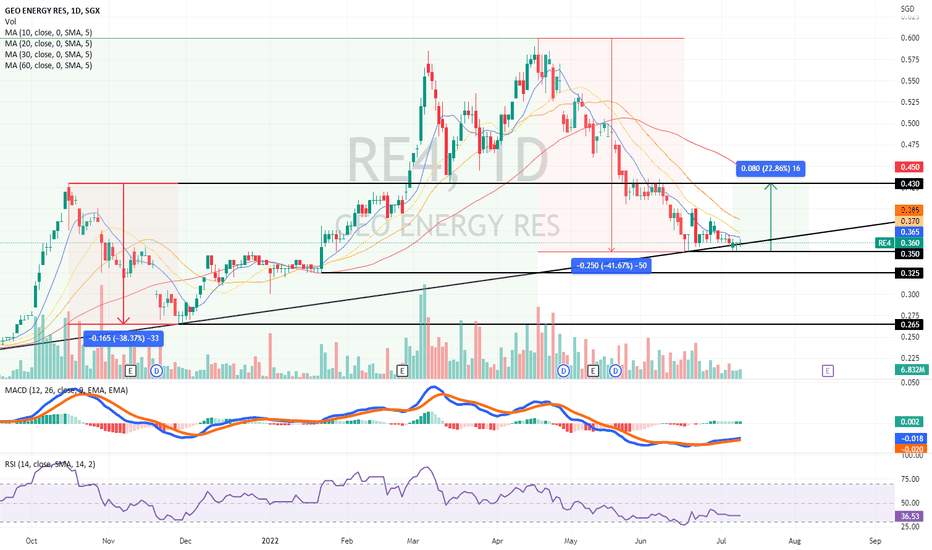

Geo Energy Share Price and Chart Analysis

The Geo Energy share price has experienced fluctuations in response to global energy market trends and commodity cycles. A detailed Geo Energy chart analysis reveals patterns that appeal to both long-term investors and short-term traders. Based on recent Geo Energy technical analysis, the stock has shown bullish momentum supported by rising trading volume.

Geo Energy Stock Review and Performance

Geo Energy stock has performed commendably in the past year, benefiting from a robust coal demand and strategic business expansion. The Geo Energy share performance in 2025 has exceeded expectations, driven by favorable market conditions and investor sentiment. Geo Energy Sharejunction returns have outpaced several other SGX-listed mining stocks.

Geo Energy Dividends and Shareholders

One of the attractive aspects for investors is Geo Energy dividends. The company has maintained a steady dividend yield, which appeals to income-focused investors. The recent Geo Energy Sharejunction corporate actions also include dividend announcements that align with its goal of maximizing shareholder value. Existing Geo Energy shareholders have benefited from both capital gains and dividend income.

Geo Energy Mining Operations and Coal Production

Geo Energy’s core business revolves around coal mining. Its mining operations in Indonesia are among the largest in Southeast Asia. The company’s Geo Energy coal business and export strategy have enabled it to capture a significant share of the regional coal market. In terms of Geo Energy production volume, the company reported record-high outputs this year, signaling operational efficiency.

Geo Energy Business Model and Sustainability

The Geo Energy business model is vertically integrated, encompassing mining, transportation, and marketing. This model ensures streamlined operations and cost efficiency. The company is also making strides in sustainability. Geo Energy Sharejunction sustainability initiatives include environmental impact reduction and adopting cleaner mining technologies. This shift is crucial for long-term viability amid global climate concerns.

Geo Energy Investment and Price Target

Geo Energy investment has become increasingly popular among institutional and retail investors. Analysts have given the Geo Energy price target a positive revision based on strong financials and future prospects. With ongoing improvements in operations and a favorable industry outlook, the Geo Energy share forecast remains optimistic.

Geo Energy News and Latest Updates

Geo Energy news in 2025 has been largely positive, with updates highlighting the company’s strong performance, strategic partnerships, and operational milestones. The Geo Energy latest updates include expansion into new coal reserves and potential diversification into renewable energy. These moves could position the company for long-term growth and improve its stock valuation.

Geo Energy Share Analysis and Prediction

A comprehensive Geo Energy share analysis involves evaluating both fundamental and technical aspects. The stock’s fundamentals are solid, with strong earnings, low debt, and growing market share. From a technical perspective, the Geo Energy Sharejunction stock prediction suggests continued upward momentum if current trends persist. Geo Energy share history shows resilience even during volatile market phases.

Geo Energy Share Rally and Stock Tips

The recent Geo Energy share rally has attracted many traders and analysts. The surge is largely supported by positive earnings reports and strategic initiatives. Several experts have offered Geo Energy stock tips, suggesting that it’s a good candidate for medium to long-term portfolios. However, like any investment, it comes with risks tied to commodity prices and regulatory changes.

Geo Energy Public Company Profile and Investor Relations

As a Geo Energy public company listed on SGX, it maintains transparent investor communication through its dedicated Geo Energy Sharejunction investor relations portal. This platform offers quarterly reports, earnings updates, and corporate announcements. The company’s efforts in maintaining strong investor relations have enhanced its reputation among the financial community.

Geo Energy Indonesia and Global Reach

While based in Singapore, Geo Energy Indonesia operations form the backbone of its business. With a strategic location and access to rich coal reserves, Indonesia provides a competitive edge. The company’s coal exports contribute significantly to revenue, and it has begun exploring other Asian markets for potential expansion.

Geo Energy Stock Performance 2025 and Future Outlook

Geo Energy stock performance 2025 has been impressive. Buoyed by solid fundamentals and a positive market environment, the company continues to grow. The Geo Energy future outlook is bright, with plans for further investment in technology, sustainability, and geographic expansion. Analysts remain bullish on its long-term prospects.

FAQs About Geo Energy Sharejunction

1. What is Geo Energy Sharejunction? Geo Energy Sharejunction refers to the community and discussion around Geo Energy’s stock on platforms like ShareJunction, where investors share insights and analysis.

2. Is Geo Energy a good investment in 2025? Yes, with strong earnings, a solid dividend yield, and positive industry trends, Geo Energy investment is considered favorable.

3. How has Geo Energy stock performed recently? Geo Energy share performance in 2025 has been strong, supported by increased coal production and favorable pricing.

4. What is the dividend yield of Geo Energy? The Geo Energy dividend yield remains competitive among SGX energy stocks, making it appealing for income investors.

5. What are Geo Energy’s main operations? The company focuses on coal mining in Indonesia, supported by logistics, export operations, and sustainability initiatives.

6. Where can I find Geo Energy financials and reports? Visit the Geo Energy investor relations section on their website for detailed financial data and reports.

7. What is the outlook for Geo Energy in the next 5 years? The Geo Energy future outlook is promising, with plans for expansion and potential entry into new energy sectors.

8. Are there risks in investing in Geo Energy stock? Yes, as with any stock, risks include commodity price volatility, environmental regulations, and global energy demand.

9. How does Geo Energy compare to other mining stocks? Geo Energy has outperformed several peers in terms of returns, production growth, and shareholder rewards.

10. What is Geo Energy’s business model? Geo Energy’s business model integrates mining, transportation, and export operations for efficient and profitable performance.

Conclusion

Geo Energy Sharejunction is more than a trending stock—it’s a company with a solid foundation in the energy sector, particularly coal mining. With impressive financials, a strong dividend policy, and an eye toward sustainability, Geo Energy Singapore has positioned itself as a key player on the SGX. Whether you’re analyzing Geo Energy share history or forecasting future returns, the company’s fundamentals support a positive investment thesis. The 2025 outlook remains strong, and continued investor interest suggests that Geo Energy Sharejunction could remain a top performer in the energy market.

Stock Market

Best USD Fixed Deposit Rates Singapore June 2025

Singapore’s banking landscape offers attractive opportunities for investors seeking to diversify their portfolios with US Dollar fixed deposits. With the monetary policy shifts and global economic dynamics influencing interest rates, understanding the current USD fixed deposit market becomes crucial for maximizing returns on your American dollar holdings.

The appeal of USD fixed deposits in Singapore extends beyond simple currency diversification. These instruments provide stability against local currency fluctuations while offering competitive returns that often outpace traditional SGD deposits. As global investors increasingly seek safe-haven assets, US Dollar deposits have gained significant traction among both retail and institutional investors.

USD Fixed Deposits in Singapore

USD Fixed Deposit Rates Singapore function similarly to their SGD counterparts but offer unique advantages for currency diversification. Banks in Singapore accept USD deposits with varying minimum amounts, typically starting from USD 1,000 to USD 10,000 depending on the institution and deposit tenure.

The mechanics involve depositing US Dollars for a predetermined period, earning interest calculated on the principal amount. Unlike regular savings accounts, these deposits lock your funds for the agreed duration, ensuring guaranteed returns regardless of market volatility. This predictability makes them particularly attractive during uncertain economic times.

Interest computation methods vary among banks, with some offering simple interest while others provide compound interest calculations. Understanding these differences helps investors make informed decisions about where to place their USD holdings for optimal growth.

Best USD Fixed Deposit Rates Singapore [June 2025]

Here’s a snapshot of the top banks and financial institutions in Singapore currently offering attractive USD fixed deposit promotions:

1. HSBC Singapore

- Interest Rate: 5.20% p.a.

- Tenure: 6 months

- Minimum Deposit: USD 25,000

HSBC is known for its global reach and stable offerings. Their USD fixed deposit promotion for June 2025 is ideal for mid-term investors looking for a strong return with a reputable institution.

2. Citibank Singapore

- Interest Rate: 5.35% p.a.

- Tenure: 3 months

- Minimum Deposit: USD 20,000

Citibank offers a short-term, high-yield USD Fixed Deposit Rates Singapore that appeals to those seeking flexibility. Perfect for investors who prefer shorter lock-in periods without sacrificing returns.

3. Standard Chartered Singapore

- Interest Rate: 5.10% p.a.

- Tenure: 12 months

- Minimum Deposit: USD 50,000

This longer-term option gives a reliable return for those who are not in immediate need of liquidity. Standard Chartered’s robust digital banking tools also make account management easy for expats and international investors.

4. Maybank Singapore

- Interest Rate: 5.30% p.a.

- Tenure: 9 months

- Minimum Deposit: USD 25,000

Maybank’s USD fixed deposit promotions combine regional trust and solid returns, catering to both individuals and SMEs holding USD reserves.

5. OCBC Bank

- Interest Rate: 5.00% p.a.

- Tenure: 6 months

- Minimum Deposit: USD 20,000

OCBC remains a top choice among Singaporeans due to its stability and accessibility. Its fixed deposit services are straightforward and transparent.

Note: Rates are accurate as of June 2025. Please check with the respective banks for the most up-to-date promotions and eligibility.

Key Factors to Consider Before Opening a USD Fixed Deposit

While chasing the best USD Fixed Deposit Rates Singapore [June 2025] can be tempting, it’s important to evaluate other critical factors:

Currency Risk

Holding your deposit in USD means you’re exposed to foreign exchange movements. If the USD weakens against the SGD by the time your deposit matures, your returns could diminish when converted back.

Tenure Flexibility

Different banks offer varied tenures — from one month to two years. Choose one based on your liquidity needs and expected market movements.

Minimum Deposit Amount

Most USD fixed deposits require a minimum of USD 20,000. Ensure you’re comfortable locking in that amount for the selected tenure.

Early Withdrawal Penalties

Breaking your fixed deposit before maturity typically results in forfeiture of interest, and sometimes additional penalties. Be sure you won’t need the funds urgently.

Bank Credibility & Insurance

Foreign currency deposits in Singapore are not covered by SDIC insurance. Opt for trusted, well-capitalized institutions to minimize risk.

Current Market Leaders in USD Fixed Deposit Rates

DBS Bank consistently ranks among the top providers for USD fixed deposits, offering competitive rates across various tenures. Their 6-month USD deposits currently provide attractive returns, particularly for amounts exceeding USD 50,000. The bank’s digital platform streamlines the deposit process, making it convenient for both local and international investors.

OCBC Bank presents compelling options for longer-term deposits, with their 12-month and 24-month USD fixed deposits offering premium rates. Their tiered interest structure rewards larger deposits with progressively higher returns, making them ideal for substantial investments.

UOB focuses on flexibility, providing various tenure options from 1 month to 60 months. Their promotional rates for new customers often exceed standard market offerings, creating opportunities for strategic timing of deposit placements.

Standard Chartered targets high-net-worth individuals with specialized USD deposit products. Their minimum deposit requirements are higher, but the corresponding interest rates justify the increased commitment for qualifying investors.

Factors Influencing USD Fixed Deposit Rates Singapore

Federal Reserve monetary policy significantly impacts USD deposit rates in Singapore. When the Fed adjusts interest rates, local banks typically respond by modifying their USD deposit offerings to maintain competitiveness and manage funding costs.

Market demand plays a crucial role in rate determination. High demand for USD deposits during economic uncertainty often leads to more competitive rates as banks compete for dollar funding. Conversely, excess USD liquidity may result in lower offered rates.

Deposit tenure directly correlates with interest rates, following the general principle that longer commitments yield higher returns. However, this relationship isn’t always linear, as banks adjust rates based on their funding needs and market outlook.

The deposit amount threshold creates tiered pricing structures. Larger deposits typically command premium rates, reflecting banks’ preference for substantial, stable funding sources. Understanding these tiers helps investors optimize their deposit strategies.

Comparing Terms and Conditions

Minimum deposit requirements vary significantly across institutions. While some banks accept USD 1,000 deposits, others require USD 10,000 or more for their premium rate tiers. Evaluating these minimums against available capital helps narrow down suitable options.

Early withdrawal penalties differ among banks, with some imposing flat fees while others calculate penalties based on remaining tenure or interest forfeiture. Understanding these terms prevents unexpected costs if circumstances require early access to funds.

Interest payment frequencies range from monthly to maturity-based payments. Monthly interest payments provide regular cash flow, while maturity-based payments often offer slightly higher effective rates through compound interest benefits.

Automatic renewal policies require careful consideration. Some banks automatically renew deposits at prevailing rates, while others require explicit instructions. Understanding these policies prevents unintended extensions or missed opportunities for rate improvements.

Best USD Fixed Deposit Rates in Singapore

The competitive landscape for USD fixed deposits reveals interesting patterns across different tenure brackets. Short-term deposits (1-6 months) currently offer rates ranging from 3.5% to 4.2% per annum, depending on the bank and deposit amount.

Medium-term deposits (6-12 months) present the sweet spot for many investors, with rates climbing to 4.5% to 5.1% annually. This tenure balances reasonable commitment periods with attractive returns, making them popular among conservative investors.

Long-term deposits (12+ months) can yield between 4.8% and 5.5% per annum for substantial amounts. While these require longer commitments, they provide certainty and higher returns for investors with extended investment horizons.

Promotional rates periodically appear, offering temporary premiums above standard rates. These limited-time offers can provide exceptional value but require careful timing and quick decision-making to capture the benefits.

Strategic Considerations for USD Deposits

Currency exposure management becomes crucial when holding USD deposits. While these instruments provide USD returns, SGD-based investors face exchange rate risks that could impact overall returns when converting back to local currency.

Diversification benefits extend beyond currency exposure to include geographical and institutional diversification. Spreading USD deposits across multiple banks reduces concentration risk while potentially capturing different rate offerings.

Liquidity planning requires balancing higher returns from longer tenures against potential needs for fund access. Laddering strategies, where deposits mature at different intervals, provide both competitive returns and periodic liquidity opportunities.

Tax implications vary for different investor categories. Understanding the tax treatment of USD deposit interest helps in accurate return calculations and overall investment planning.

Maximizing Returns on USD Fixed Deposits

Timing deposit placements strategically can significantly impact returns. Monitoring interest rate cycles and economic indicators helps identify optimal placement windows for maximum benefit.

Negotiating with relationship managers, particularly for larger deposits, often yields better terms than published rates. Banks value substantial, stable deposits and may offer preferential pricing for significant commitments.

Combining multiple products can unlock premium rates. Some banks offer enhanced USD deposit rates for customers maintaining comprehensive banking relationships, including investment accounts or credit facilities.

Regular market monitoring ensures awareness of changing rate environments. Setting alerts for rate improvements or promotional offerings helps capture opportunities as they arise.

Summary

The USD fixed deposit market in Singapore offers compelling opportunities for investors seeking stable, predictable returns while diversifying currency exposure. With rates currently ranging from 3.5% to 5.5% depending on tenure and deposit size, these instruments provide attractive alternatives to traditional SGD deposits. Success in maximizing returns requires understanding rate structures, comparing terms across institutions, and strategically timing deposit placements. While currency risks exist for SGD-based investors, the stability and competitive returns of USD fixed deposits make them valuable components of diversified investment portfolios. Regular monitoring of market conditions and maintaining relationships with multiple banks ensures access to the best available rates as market dynamics evolve.

-

Blog4 months ago

Wedding day horror: Groom falls to death at VOCO Orchard Hotel on Wedding Day

-

Technology3 months ago

Technology3 months agoEdTech in Singapore: 150+ Companies Driving $180M Digital Learning Revolution

-

Education6 months ago

Education6 months agoSingapore JC Ranking: A Complete Guide for Students

-

Food2 months ago

Food2 months agoYi Dian Dian Bubble Tea Singapore: Menu, Outlets & Try Drinks

-

Blog6 months ago

Blog6 months agoBest of SG with Singapore Rediscover Voucher

-

Business6 months ago

Business6 months agoWhat to Expect During PSLE Marking Days 2023

-

Digital Marketing3 months ago

Digital Marketing3 months agoHow to Run Effective Xiaohongshu Advertising Campaigns

-

Digital Marketing3 months ago

Digital Marketing3 months agoWhy Xiaohongshu Ads Are a Must for Reaching Chinese Consumers